Investors

We are more than a financial institution

+20 years

in the financial sector

Over

1,125,000

loans granted

Investors

SOFIPA: Responsible Investment and Shared Goals

........

Financial inclusion:

SOFIPA facilita el acceso a crédito para emprendedores y pequeños negocios que no tienen acceso a financiamiento tradicional.

........

Social impact:

Its group lending model and financial education strengthen communities and improve clients’ quality of life.

........

Purpose-driven returns:

These funds seek sustainable investments that generate financial returns while driving economic development.

........

Expansion and growth:

SOFIPA has a scalable model that allows it to expand its impact across more regions.

Investors

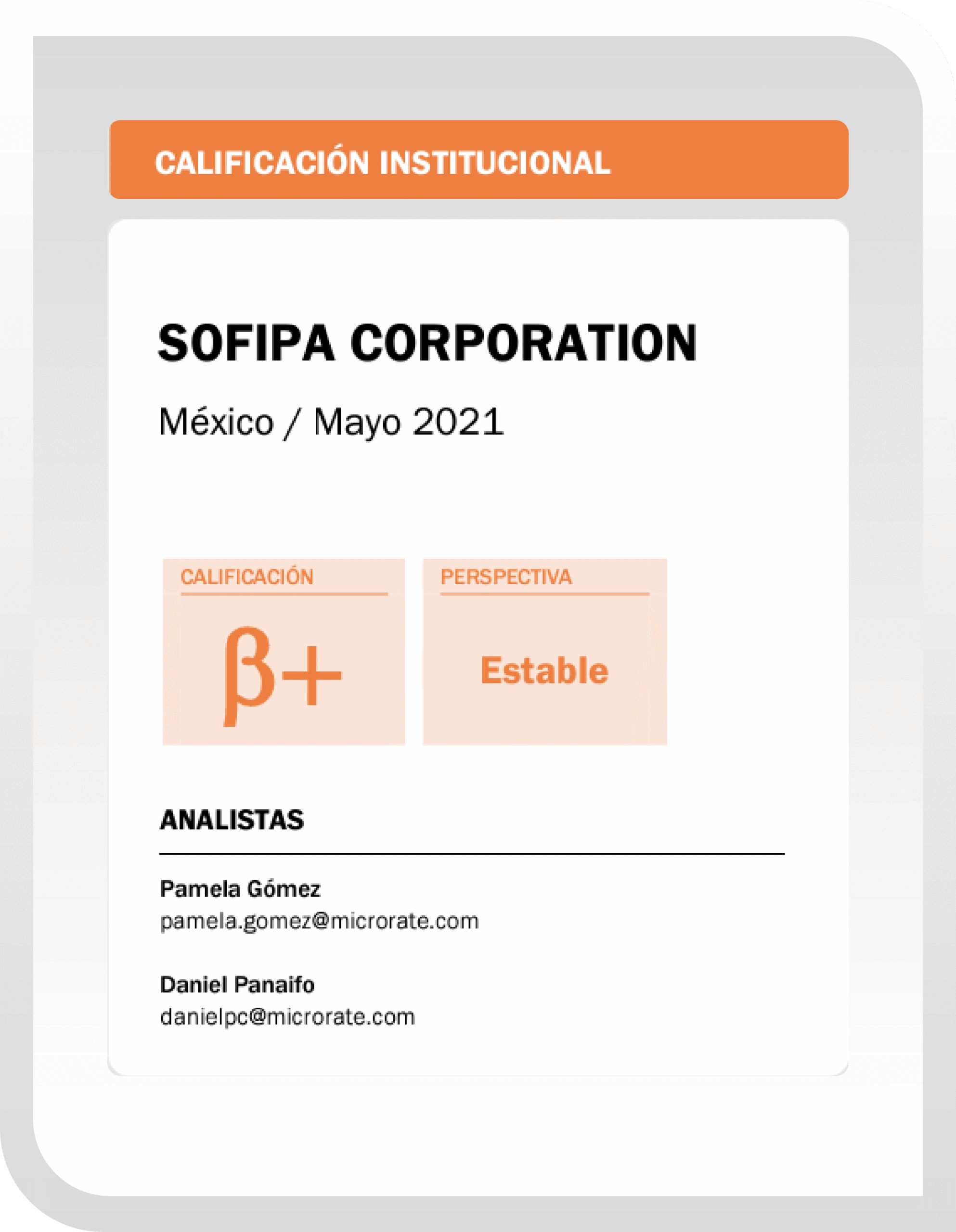

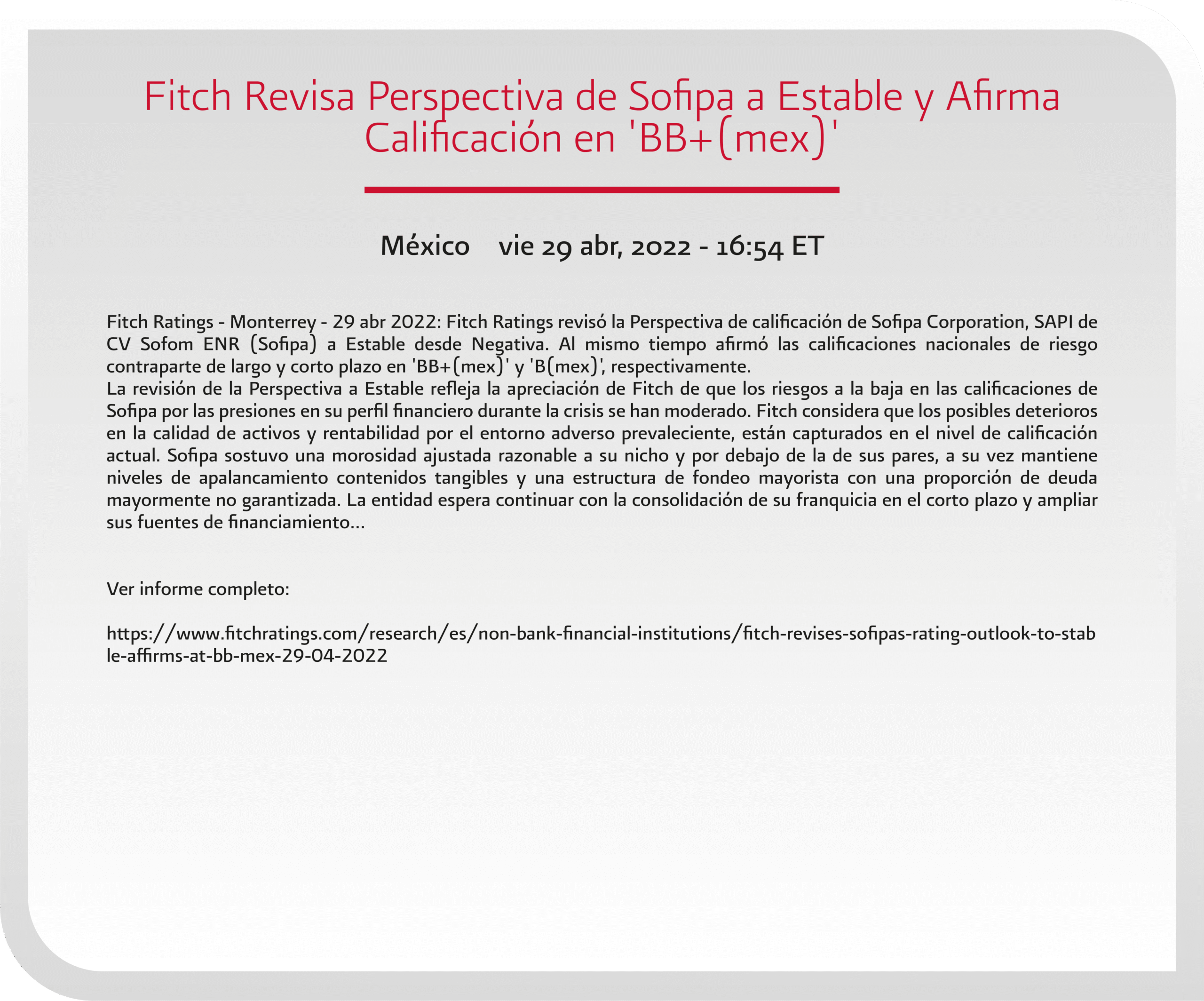

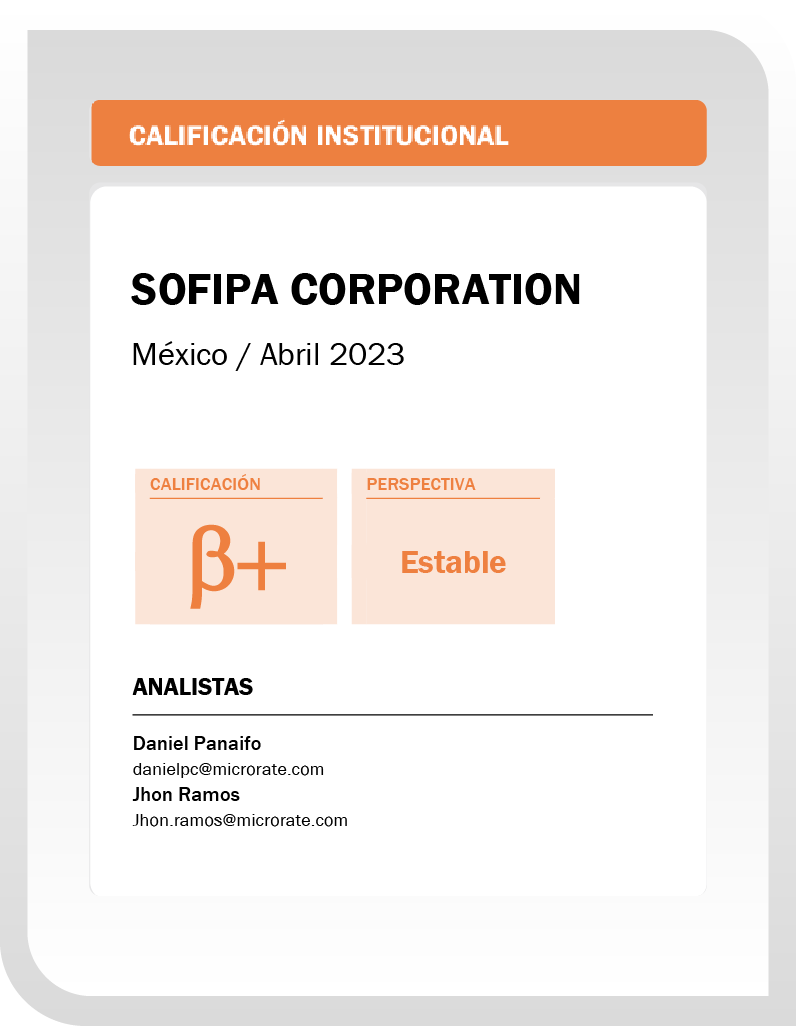

Credit Ratings

| 2020 | 2021 | 2022 |

|---|---|---|

×

×

×

.

|

×

×

×

.

|

×

×

×

|

Investors

Investor Questions

1 Carlos Gracida Street, 3rd Floor, 24 de Febrero Neighborhood (6th Section), San Antonio de la Cal, Oaxaca, ZIP Code 71255

Contact Isabel López González, Funding Relations Coordinator, phone: +52 9515017100 ext 1016, email: isabel.lopez@sofipa.org.mx

SOFIPA offers competitive returns based on a solid business model and a diversified loan portfolio. Risks are managed through thorough client analysis, structured credit policies, and continuous monitoring systems that reduce delinquency.

SOFIPA operates under an accessible financing model focused on sectors typically underserved by traditional banks. Its strategy centers on sustained growth, financial inclusion, and process optimization to provide efficient and transparent service.

Investments made by funders in SOFIPA have a significant impact on the economic and social development of the communities served. Thanks to these funds, SOFIPA can offer accessible financing to entrepreneurs and small businesses, strengthening the local economy and promoting sustainable growth. Moreover, these investments foster financial inclusion by allowing people with limited access to banking services to improve their quality of life and generate job opportunities. In short, funder support drives economic and social progress, reaffirming the commitment to holistic community development.

Investments enable entrepreneurs and small businesses to access financing, promoting job creation and local economic development. To measure impact, we use various metrics, including indicators that reflect the achievement of our social goals. We also use tools based on the PPI methodology to assess the likelihood of a person living below the poverty line within our target market. Additionally, we implement self-assessment tools such as SPI from Cerise + SPTF, customer satisfaction metrics like Net Promoter Score, and impact measurement through 60 Decibels, allowing us to accurately evaluate the outcomes of our work.

They share a focus on impact investing—aiming to generate financial returns while contributing to social and economic development. Their focus includes areas such as financial inclusion, microenterprise support, sustainability, and community development.